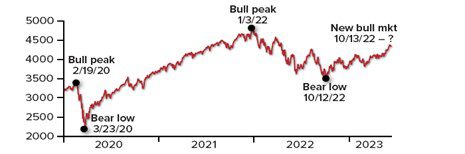

On July 31, 2023, the S&P 500 index closed at 4,588, over 25% higher than its lowest closing value of 3,577 reached on October 12, 2022.1 The official bull market began on October 13, 2022, the day after the bear market ended at its lowest point.

Bull markets tend to last longer than bear markets, and bull gains tend to be greater than bear losses. Since the end of World War II, the average bull market has lasted more than five years with a cumulative gain of 177%. By contrast, the average bear market has lasted about a year with a cumulative loss of 33%.2

Although a bull market is typically a time for celebration by investors, the current bull is being met cautiously. While it is impossible to predict market direction, here are some factors to consider.

Still Lagging the High

One reason the new bull might not seem convincing is that (as of late July) the S&P 500 remains well below the record bull market peak in early January 2022.

The current bull is already nine months old, and it’s unknown how much longer it might take to recover the total bear loss of about 25%. The last bull market regained the pandemic bear loss of 34% in five months and went on to a cumulative gain of 114%. The long bull market that followed the Great Recession took more than four years to recover an even steeper loss of 57%. But that bull kept charging and went on to a gain of 400%.4–5

A Narrow Rally

Another key concern is that the current rally has been driven by large technology companies, which have posted big gains, due in part to excitement over the future of artificial intelligence.7 The S&P 500 is a market-cap-weighted index, which means that companies with larger market capitalization (number of shares multiplied by share price) have an outsized effect on index performance. As of May 31, the ten biggest companies — including eight technology companies — accounted for more than 30% of index value.8 Fewer than one out of four S&P 500 stocks have beaten the index in 2023, and nearly half have dropped in value. While it is not unusual for a relatively small number of companies to drive a rally, the current situation is more imbalanced than usual, and it remains to be seen whether exuberance for Big Tech will spread to the larger market.9–10

The Market and the Economy

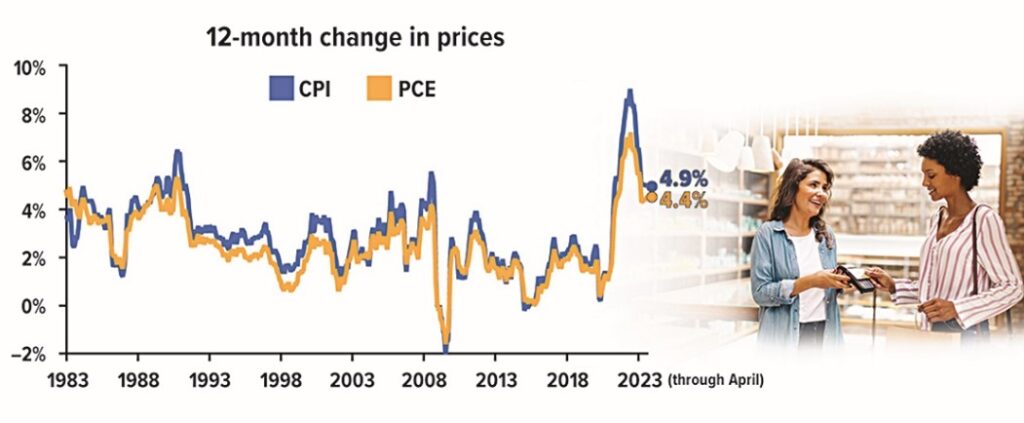

While the stock market sometimes seems to have a mind of its own, it is anchored over the longer term to the U.S. economy, and the current economy continues to send mixed signals. The long-predicted recession has so far failed to materialize, and both consumer spending and the job market remain strong.11 On the other hand, inflation, while improving, is still too high for a healthy economy. Higher interest rates are intended to slow the economy and inflation by making it more expensive for consumers and businesses to borrow, which should slow consumer spending and business growth — and could send the economy into a recession. Although it may seem counterintuitive, bull markets usually begin during a recession, or to look at it another way, the market usually hits bottom while the economy is down and recovers along with the broader economy. Along the same lines, a bull market typically begins when the Fed is lowering interest rates to stimulate the economy, not when it’s raising them to slow it down.13 The current bull will have to buck both trends to sustain momentum.

Corporate Earnings

Although investor enthusiasm can carry the market a long way, corporate earnings are the most fundamental factor in market performance, and the earnings picture is also mixed. Earnings declined by 2% in Q1 2023 — less of a loss than analysts expected but the second consecutive quarter of earnings declines. The good news is that earnings growth is expected to return in the second half of the year, with robust growth of 8.2% in Q4. As with the current market rally, however, the surge is projected to be driven by large technology companies.14

Global equity markets generally advanced in July, with the best performance for the month coming from Energy, Communication Services, and Financials. Commodities had a very strong month with gains in energy, precious metals, base metals, and agriculture. And international equity markets were particularly strong, led by gains in emerging markets.15

Clearly, this bull market faces serious headwinds, and it may be some time before its true character emerges. While market cycles are important, it’s generally not wise to overreact to short-term shifts and better to focus on a long-term investment strategy appropriate for your personal goals, time frame, and risk tolerance. Be sure to call to go over your portfolio and let me know if any major changes have occurred. We always need to review annually so call 972-546-0620 and let’s visit.

Office News Updates

Advisor Group announced that it has changed its name and rebranded as Osaic. By bringing all eight of its wealth management firms together under one brand, Osaic will be better positioned to serve the financial professionals by offering us a simplified business structure to reduce complexity through a unified platform, technology stack, procedures, and support model. It was also built with you in mind because our clients are the ones who matter most. As the firm phases in the new branding, you will get notifications in the mail regarding your accounts. Nothing is changing on your accounts as we still clear through National Financial Services/a Fidelity company. Please call with any questions or concerns.

1, 3–4, 8) S&P Dow Jones Indices, 2023

2, 5) Yardeni Research, October 28, 2022

6) MarketWatch, June 8, 2023

7, 9) CNN, June 9, 2023

10) Associated Press, June 8, 2023

11) Fitch Ratings, June 8, 2023

12) CNBC, June 21, 2023

13) Bloomberg, June 5, 2023

14) FactSet, June 9, 2023

15) Broadridge Solutions July 30, 2023

This article is for informational purposes only. Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful. This information is not intended to be a substitute for specific individualized tax, legal or investment planning advice as individual situations will vary. The views expressed are not necessarily the opinion of Osaic, and should not be construed, directly or indirectly, as an offer to buy or sell securities mentioned herein. Past performance is no guarantee of future results.

Securities and investment advisory services offered through Osaic Wealth, Inc. (“Osaic”), member FINRA / SIPC. Osaic is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic. Insurance and services offered by Gigi Lavergne or TRI Planning is independent of Osaic.